How Can I Withdraw Money From Chime Without My Card

Chime

Chime

How To Withdraw Money From Chime Without a Card

Oct 8, 2021

Do you need to withdraw cash from your Chime account without a card? Perhaps you've lost your card, forgotten it at home, or otherwise don't have it with you? While it's not a smooth process, it's fortunately possible to withdraw money from Chime without a card so long as you have a friend who uses a Chime card or you have another bank account to which you can transfer money and withdraw.

Unfortunately however, as of October 2021, it's impossible to withdraw money from Chime without a card as the platform currently doesn't offer cardless withdrawals. In this guide, we explore some helpful workarounds for getting money out of Chime without a card before weighing up practical alternatives to use instead.

Does Chime Offer Cardless Withdrawals?

No, Chime doesn't offer cardless ATM withdrawals, meaning you cannot withdraw money from Chime if you don't have your debit card on you.

Despite providing access to free withdrawals from over 55 thousand ATMs nationwide (around 19 thousand of which offer cardless withdrawal services¹), it's currently not possible to withdraw money from any of these machines without a card because Chime has yet to build in the necessary functionality to process these types of transactions.

As such, the only way to withdraw cash from Chime is using your debit card at an ATM or over-the-counter* at most major banks or credit union branches (where you'll also be required to show your debit card).

* Comes with a $2.50 fee with a maximum withdrawal of $500 per day.

Option 1 — Use Another Account or Card

Guzmán Barquín on Unsplash

If you don't have a Chime debit card, you'll probably have another bank account or card to use to withdraw money from at an ATM. This could either be a debit card linked to a bank account at another bank or a credit card.

If you have a debit card, you can even transfer money from your Chime account to the associated bank account via ACH (as Chime doesn't support bank wires this process can take up to two days to complete). You can do this by tapping Link a Bank Account in the Chime app or website, choosing from among the banks listed, and entering your other bank's login details². Once the transfer arrives, you'll be able to withdraw money from an ATM via debit card using cash that had initially been from your Chime account.

However, naturally enough, this method won't work if you've lost or forgotten your entire wallet along with your Chime card!

What You'll Need

- An account and card from another bank or

- A credit card.

Option 2 — Ask a Friend To Do It for You

Taylor Smith on Unsplash

If you have a friend who uses Chime themselves and is ready and available to help, then asking them to withdraw the money for you is an excellent option if you don't have a Chime card yourself.

To get the job done, all you need to do is go to the Friends tab in the Chime mobile app, type in friend's details name or username ("$ChimeSign"), enter the amount you'd like to send, and then tap Pay now to instruct the transfer.

The good part of this method is that not only are transfers between Chime users free of charge, but they're also instant, meaning you can send your friend some cash and ask them to withdraw it for you using their card quickly and cheaply. However, be mindful that you can only transfer up to $2,000 per month this way³.

What You'll Need

- A friend;

- A Chime account with sufficient balance;

- A smartphone or other device with an internet connection.

Option 3 — Use a Mobile Payment App

Matthew Kwong on Unsplash

This is available if you don't necessarily need to withdraw cash from an ATM but want to access your Chime balance to pay using other methods (e.g. online or point-of-sales payments*). In this case, it's always a good idea to have your Chime account linked to a mobile wallet or digital payment solution, the most popular of which in the US include:

- Apple Wallet;

- Google Pay;

- Vemo;

- PayPal;

- Zelle;

- Cash App.

To link your Chime account to one of these mobile payment solutions, you can add your Chime account as a payment method in their mobile app and transfer money to your Chime account via ACH transfer.

You can also use your smartphone to pay by scanning a barcode and having the money deducted directly from your Chime balance (a feature also available through the Chime app).

What You'll Need

- A smartphone;

- A Chime account with sufficient balance;

- A P2P mobile payments app.

* Up to a maximum of $2,500 per day.

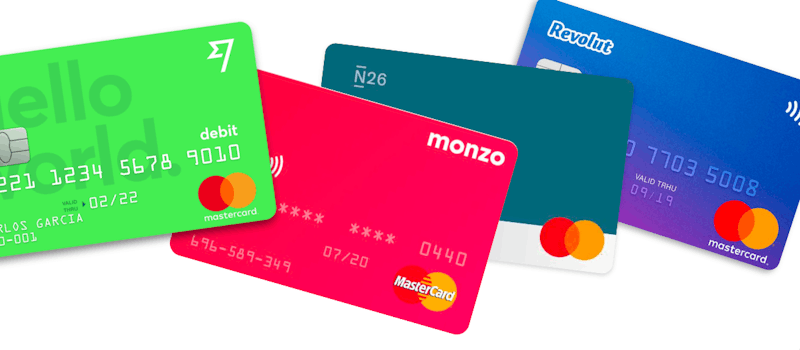

Option 4 — Use a Global Debit Card

Whether you don't own a Chime card, lost it, or forgot it at home, the most effective way to withdraw cash is to use a prepaid debit card specially designed for low-fee transactions — including ATM withdrawals.

Using a competitive travel card product, you can dodge ATM withdrawal fees altogether, even when travelling overseas and spending in a foreign currency. (The only costs you might incur in these instances could be network fees from the ATM itself or a small Visa or Mastercard exchange rate markup, although it depends on the card.)

If you travel abroad from the US frequently, one of the best options available is to open a Wise Multi-Currency Account, which gives you access to a current online account, multi-currency balances, and a debit Visa or Mastercard.

8.9

Monito score

Once you're signed up, and your card has arrived (which takes up to 3 weeks in the US), you'll be able to take advantage of the following unique features:

- Local bank details in the US, Eurozone, UK, Australia, New Zealand, Singapore, Romania, Canada, Hungary, and Turkey;

- Hold, exchange, and top-up up to 56 currencies;

- A multi-currency Mastercard debit card that's handy for paying in foreign currencies without the hidden fees;

- Access to Wise's powerful international money transfer service right from your account balance.

We also recommend taking a look at our pick of the best banks for international travel (number one is among the best options out there for fee-free international withdrawals).

What You'll Need

- Proof of residence;

- A valid ID (e.g. driver's license, passport, social security card, etc.);

References Used in This Guide

See Other Monito Guides for Withdrawing Money Without a Card

How Can I Withdraw Money From Chime Without My Card

Source: https://www.monito.com/en/wiki/withdraw-money-from-chime-without-card

Posted by: mertzaffecke.blogspot.com

0 Response to "How Can I Withdraw Money From Chime Without My Card"

Post a Comment